In South Africa’s branch-light banking market, the TymeBank EveryDay Account solves basic money tasks quickly, safely, and at very low cost.

Zero monthly fees, a free Visa debit card, and essential day-to-day transactions at no charge make it an easy default for salary deposits and bills.

Because account opening can happen in minutes and card collection is instant at in-store kiosks, setup suits real life rather than paperwork. Details below reflect official TymeBank materials checked on 2025, and should be verified on the live fees page before applying.

What The TymeBank EveryDay Account Is

TymeBank runs a digital-first account supported by supermarket kiosks, allowing fully regulated banking without traditional branches.

The product centers on a no-monthly-fee structure, free local card purchases, free bill payments, and free EFTs to cover routine transactions.

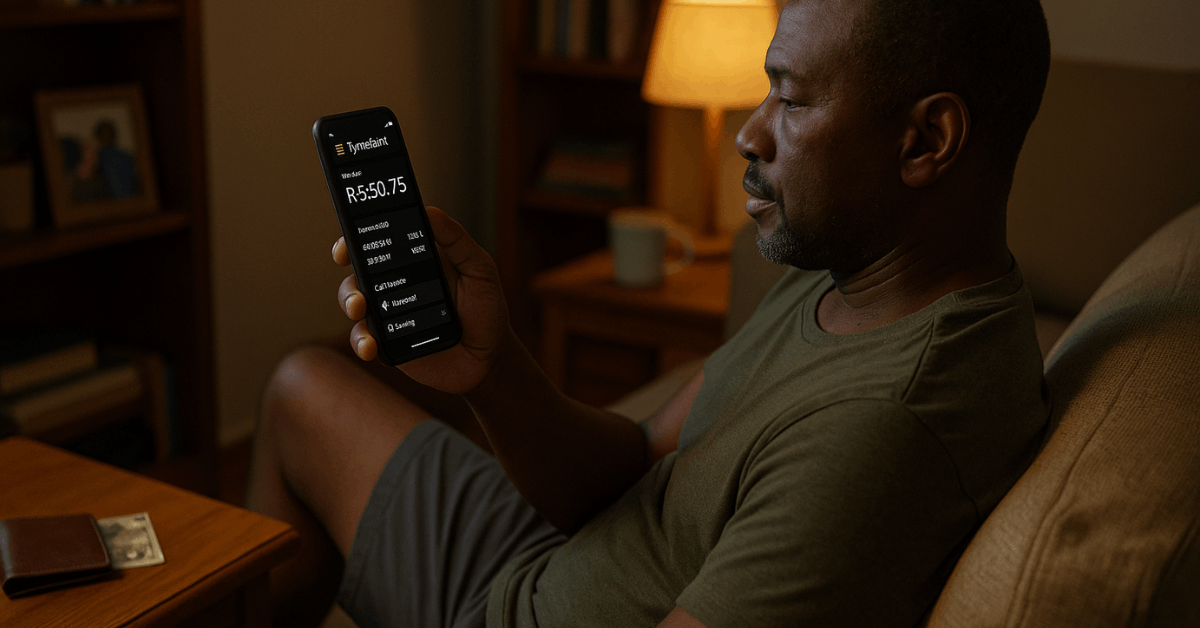

Card collection happens in-store, while the TymeBank app and mobile web handle balance checks, transfers, payments, and security controls. Official pages confirm no monthly account fees and a wide set of free transactions, backed by kiosk and retailer partners for cash handling.

Key Benefits And Costs Snapshot

Figures differ for ATM and retailer channels, and retailers keep specific operating hours.

Because prices can change, confirm the latest fees on TymeBank’s EveryDay Account page before transacting.

| Feature | What To Expect |

| Monthly account fee | zero monthly fees on the core account |

| Card purchases (local) | free swipes and local online card payments |

| EFT payments | free EFTs for standard bank-to-bank transfers |

| Cash at Pick n Pay or Boxer | Pick n Pay deposits accepted; TymeCode withdrawals supported at tills |

| Card and access | free Visa debit card collected at a TymeBank kiosk |

Official TymeBank pages outline zero monthly account charges, free everyday card usage, and low-cost or free cash options at Pick n Pay and Boxer tills.

Retailer-till withdrawals use a TymeCode generated in-app or online, while kiosk collection enables immediate card use.

How To Open an Account In 5 Minutes

Fast onboarding is the main appeal for busy applicants. Card issuance happens at in-store kiosks across major retail partners, while digital verification finalizes access limits.

Plan to keep mobile data available and have an identity number ready, since the flow relies on quick checks and a one-time selfie for full functionality.

Kiosk guidance indicates an under-five-minute sign-up when documents and biometrics match on the first attempt.

- Start on the TymeBank app or the internet banking site, then enter basic details to open the profile.

- Generate or receive the profile login credentials, then proceed to the nearest TymeBank kiosk in a Pick n Pay or Boxer store.

- Follow the kiosk prompts, authenticate using fingerprints where requested, and print or collect the Visa debit card.

- Activate the card in the TymeBank app, set a secure PIN, and enable alerts for card usage and transfers.

- Complete the selfie-based verification in the app to lift provisional limits and unlock all account features.

Cash Deposits And Withdrawals That Work Everywhere

Retail till points handle cash reliably during store hours, which helps in areas underserved by ATMs. Pick n Pay deposits credit the account at the till, using either the card or a TymeCode created in the app or online banking.

TymeCode withdrawals also work at Pick n Pay and Boxer tills, which reduces ATM dependence and preserves predictable fees for cash-out.

Official guidance explains the TymeCode process for both deposit and withdrawal at partner retailers, and notes that standard ATM withdrawals remain available nationwide using the card.

App, Online Banking, And Kiosk Controls

Daily tasks revolve around the TymeBank app, which supports payments, EFTs, debit-order tracking, and card controls.

Internet banking mirrors core features for those who prefer desktop browsers, while kiosks assist with account opening, card collection, and selected updates.

Balance inquiries are free across digital channels and kiosks, which encourages frequent checks without extra cost. Product pages highlight that many essential transactions remain free, keeping ongoing costs low for routine bills and card purchases.

Limits, Verification, And FICA Requirements

South African banks apply Financial Intelligence Centre Act rules to verify identity and manage account limits, which TymeBank handles digitally. A quick selfie verification aligns the profile to the FICA requirements and unlocks higher balances and full access after initial onboarding.

Official verification pages outline the selfie step and show how non-biometric profiles carry lower limits until verification completes successfully.

Completing this step immediately after card collection prevents payment failures or rejected deposits caused by provisional limits.

Mistakes That Slow Down Opening Or Use

Short delays typically trace back to avoidable issues. A quick check on the following points clears most obstacles in minutes.

- Incomplete personal details cause failed matches; ensure names and ID number match government records exactly.

- Poor lighting during selfie verification triggers retries; choose a well-lit background and hold still for a clean capture.

- Skipping app activation for the Visa debit card blocks card usage; set the PIN and enable notifications immediately.

- Arriving at a closed retailer kiosk wastes time; confirm store hours for Pick n Pay or Boxer before heading out.

- Generating the wrong TymeCode type causes errors at tills; select deposit or withdrawal as required in the app.

Who This Account Suits and Practical Use Cases

Freelancers, students, and salaried workers benefit equally when fixed monthly fees disappear from the budget. Salary deposits flow through the account without penalty charges, while free everyday card usage makes card-present purchases painless.

Bill pay and free EFTs keep utilities and rent current at minimal cost, and TymeCode withdrawals offer contingency cash-out when ATMs fail or queues run long.

Because the card collects instantly at kiosks in major retailers, moving from approval to first purchase often happens the same day.

Where The Proof Comes From

Official product and help pages confirm zero monthly fees, free essential transactions, kiosk card collection, TymeCode at tills, and selfie-based verification. TymeBank also publishes guidance on using partner tills and ATM networks for cash in or out.

Background material provided to Parliament shows the long-standing pricing intent of free monthly fees, free card swipes, and low-cost cash handling at retail partners; however, always rely on the current fees page for final amounts.

How To Use This Guide In Practice

After collecting the card, prioritize two tasks immediately: selfie verification and enabling alerts for all card activity.

Because those two actions reduce limits-related friction and expose fraudulent spending quickly, they materially improve the first week’s experience.

When cash is necessary, favor TymeCode withdrawals at Pick n Pay and Boxer tills to avoid inconsistent ATM surcharges, then default to standard ATM usage after hours as needed. TymeBank’s help and fees pages should be checked periodically, since retailer and network charges can change without notice.

Quick Compliance And Safety Notes

Because the account operates under South African regulation, FICA requirements govern identity verification and usage limits throughout the lifecycle.

When onboarding information changes, update records in the TymeBank app and repeat biometric verification if prompted, which prevents freezes triggered by regulatory checks.

Lost or stolen cards should be frozen in-app immediately, followed by a replacement request through support or a kiosk visit. Policy pages and verification guidance explain naming, verification, and privacy practices that apply to profile data.

Fast Start: One-Week Setup Checklist

A short setup window ensures smooth use once income and bills start moving. After card activation and selfie verification, schedule a test EFT, a small card purchase, and a trial TymeCode withdrawal at a nearby retailer.

Those three actions validate card, transfer, and cash-out paths ahead of paycheck day and reduce surprises. Keep an eye on statements in the app during the first week to confirm merchant descriptors and debit-order details align with expectations.

Conclusion

In practice, the EveryDay Account cuts friction on the tasks that matter daily and keeps costs transparent. Open the profile in minutes, collect the card at a kiosk, and start transacting on core items for free.

Keep costs predictable by using TymeCode cash options at tills and checking the live fees page before cash handling.

Secure the account quickly by completing selfie verification, enabling alerts, and setting a strong PIN for card and EFT activity. For salaries, bills, and routine purchases, the zero monthly fee structure delivers reliable value without surprises.