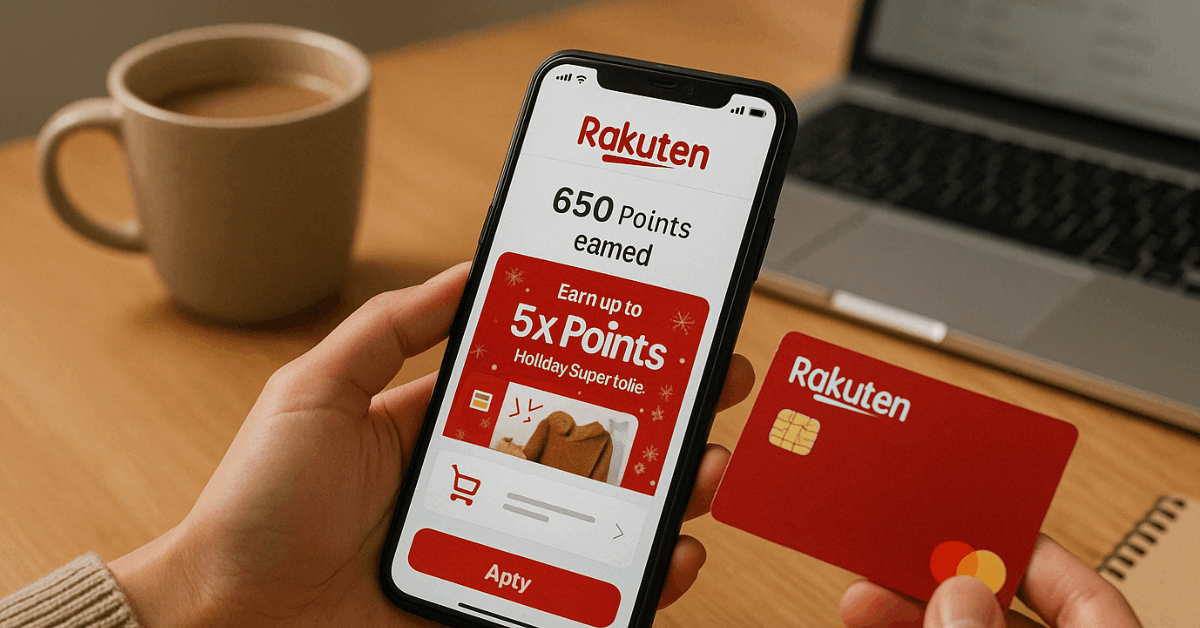

Rakuten Credit Card provides flexible benefits, a simple online application, and multiple reward features.

You gain access to convenient cashless payments, broad acceptance at countless merchants, and several card variations suited to different income levels or spending habits.

This guide covers the core details you need, using a direct, global perspective free of complicated jargon or fluff.

Overview of Rakuten Credit Card

Rakuten has established a massive presence in Japan and operates in various areas, including e-commerce, finance, and mobile services.

A credit card under this umbrella promises a range of features that appeal to both frequent online shoppers and everyday spenders.

You can capitalize on frequent cashback and point bonuses, which are redeemable for real-world value within Rakuten’s ecosystem. Rakuten Credit Card stands out because:

- No Annual Fee (Certain Cards): Many users enjoy a cost-free experience with no yearly fee on select types.

- Generous Point System: Spending triggers loyalty points (often 1 point per 100 units of currency) with chances for bonus rates on partner platforms.

- Broad Eligibility: The brand supports applications from foreign residents and does not limit approvals strictly to a single country.

- Convenient Payment Options: Monthly bills are deducted automatically, and the system offers flexible installment plans that fit varying budgets.

Key Advantages for a Global Audience

Rakuten Credit Card is built to cater to an international community, making it relevant regardless of location or typical shopping patterns.

You get the convenience of:

- Acceptance: Both online and offline merchants process Visa, MasterCard, or JCB versions of the card.

- Global Cash Withdrawals: Using designated ATMs allows you to withdraw local currency when traveling.

- No Language Barrier for Basic Tasks: Even if certain application screens show up in another language, browser translation tools help you finalize the process smoothly.

Points earned on global or domestic purchases can merge into your Rakuten account, letting you redeem them for various services or items. Whenever you shop at specific partner stores—especially within Rakuten’s marketplace—you unlock additional perks.

Types of Rakuten Credit Cards

Rakuten offers multiple card variants, each designed for different spending profiles. You select the card that aligns with your lifestyle, income, and usage goals.

Primary options include:

- Rakuten Standard Card:

- No annual fee.

- Visa, MasterCard, or JCB acceptance.

- Straightforward point accumulation rate (1 point per 100 spent).

- Rakuten Pink Card:

- Same core features as the Standard Card.

- Pink card design is typically marketed toward certain user groups wanting a unique look.

- Includes special discounts on certain lifestyle services.

- Rakuten Gold Card:

- Modest annual fee (around 2,000+ units of currency).

- Higher credit limits.

- Additional perks like airport lounge access.

- Rakuten Premium Card:

- Higher annual fee (around 10,800 units of currency).

- Top-tier services, extra lounge visits, and enhanced point rates.

- Suited to individuals who prefer premium travel benefits or higher spending thresholds.

Smart Tips Before Applying

Prospective applicants benefit from proper financial preparation. These are important guidelines that help ensure a smoother experience:

- Maintain Sufficient Bank Balance: Monthly charges usually get deducted on a specific date (often the 27th), so aim to keep enough funds in the linked account.

- Align Installments with Income: Splitting payments can ease budgeting, though paying in full often avoids extra interest.

- Check Potential Late Fees: Delayed payments can trigger interest charges and may negatively impact credit standing.

- Choose the Right Card Type: An everyday shopper might opt for Standard or Pink, while frequent travelers or higher spenders might benefit from Gold or Premium features.

Earning Points and Maximizing Value

Rakuten’s loyalty program rewards you for ordinary shopping habits, making day-to-day spending more valuable:

- Base Rate: Earn 1 point for every 100 units spent.

- Bonus Campaigns: Select merchants or promotions multiply the base rate.

- Utilities and Bills: Turning your recurring bills (e.g., electricity, water) into credit card charges produces consistent points.

Each point typically equates to one unit of currency, which you can redeem for discounts on Rakuten’s marketplace or other affiliated services.

Reaching higher member status levels unlocks stronger bonus rates and additional perks. International transactions can also accumulate points, further expanding ways to generate rewards.

Step-by-Step Guide to Rakuten Credit Card Application

Applying online is the fastest way to secure a Rakuten Credit Card.

The process is generally user-friendly, even for foreign residents in Japan. These steps are typical, though minor differences might exist based on specific regions:

- Visit the Official Rakuten Card Website

- Look for the easy application prompt or the “お申し込み” (apply) button.

- Create a Rakuten account if needed, which takes only a few minutes.

- Provide Personal Details

- Enter name (in the required format), date of birth, and contact information.

- Supply an address and confirm relevant household data.

- Include details on gender and marital status if requested.

- Select Card Type and Brand

- Pick Standard, Pink, Gold, or Premium, depending on personal preferences.

- Choose Visa, MasterCard, or JCB for broad acceptance in Japan.

- Add Employment and Income Info

- Disclose job type (full-time, part-time, freelance, or student).

- Provide annual income estimates or official figures.

- Declare any existing loans or financial obligations.

- Link Your Bank Account

- Input banking details for automatic monthly deductions.

- Ensure your account can handle digital transfers without hurdles.

- Review Terms and Conditions

- Check interest rates and relevant fees to avoid misunderstandings.

- Confirm agreement with the official disclaimers and user policies.

- Submit Application and Wait for Approval

- Wait several days (or up to a couple of weeks) for official confirmation.

- Receive an email or letter indicating final status.

- Once approved, expect the physical card by mail or select local delivery.

In many instances, a credit card application can stall due to small details. These suggestions help keep everything on track:

- Check Name Formatting: Some forms require kana, hiragana, or Romanized spelling, so watch for instructions.

- Ensure Accurate Income Figures: Understating or overstating income may raise red flags.

- Keep Documents Handy: Proof of identity or residency might be needed.

- Avoid Typos: Errors in phone or address details slow the process.

A prompt response to any Rakuten inquiry helps accelerate approval. Monitoring your email or phone for messages ensures you do not miss time-sensitive requests.

Handling Payments, Fees, and Rates

Rakuten Credit Card offers multiple payment options. You might pay the full statement or choose installments, though interest adds up if balances roll over.

Commonly quoted rates hover around 15% to 18 annually. This figure can vary based on card type, promotional offers, or the nature of the transaction (cash advances often have higher rates).

Key payment points include:

- Automatic Debit: Linking a valid bank account for scheduled deduction on the due date.

- Potential Installment Plans: Interest charges apply for multi-month splits.

- Late Payment Penalties: Missing your due date triggers fees and negative marks.

- Avoiding Unnecessary Debt: Paying balances in full each month eliminates interest charges altogether.

Annual fees differ across card types. Standard or Pink often have zero annual cost, while Gold or Premium carry yearly charges in exchange for exclusive privileges like lounge access or higher credit limits.

Customer Support Channels

Rakuten in Japan offers robust assistance for all credit card users. Various options help resolve concerns around billing, security, or lost cards:

- Phone Support: A dedicated hotline often exists (for example, 0570-66-6910) for direct conversation with an agent.

- Email Inquiries: Official support addresses or contact forms are helpful for simpler queries.

- Online Resources: Rakuten’s FAQ, tutorials, and user forums cover many common obstacles, like login errors or payment tracking.

- Physical Office Visits: Some regions allow in-person assistance at a central location (e.g., Rakuten Crimson House in Tokyo), though many queries are solvable online.

Conclusion

Rakuten welcomes a wide range of applicants in Japan, including foreign residents who meet basic requirements such as age, income stability, or student enrollment.

Spending limits are generally influenced by income and employment status, but Rakuten remains accessible to users across various professional backgrounds.

Disclaimer: Eligibility criteria may vary and are subject to Rakuten’s latest policies and local financial regulations.