AEON Suica Credit Card merges everyday purchasing power with convenient transit payments, creating a combined resource that supports global users seeking a streamlined financial and commuting experience.

This card’s practical features suit individuals who aim to consolidate their daily spending and mobility in one tool, while also earning valuable rewards.

The following sections present a well-structured guide that explains how to apply online, meet eligibility requirements, manage spending effectively, and take advantage of all the benefits associated with this unique credit card.

Key Advantages That Make This Card Worth Considering

AEON Suica Credit Card stands out as a dual-purpose tool, merging Suica transit functions with a credit line that supports essential purchases and daily transactions.

This approach suits people determined to avoid juggling multiple cards for different tasks.

- One-Card Convenience: Easily handle public transit fares and everyday shopping without needing multiple payment instruments or separate transportation passes.

- Earning Points for Regular Spending: Receive WAON Points for all transactions, which include typical daily purchases and commuter-related costs.

- Extra Perks at Select Retailers: Benefit from enhanced points accumulation at AEON-affiliated stores in Japan, plus scheduled discount days that make routine grocery and household shopping more affordable.

- Straightforward Online Management: Track recent purchases, check statements, and modify settings through an online portal or the official mobile application anytime.

- Added Movie and Travel Discounts: Access cheaper cinema tickets, plus select travel rebates that lower the total outlay for tours and accommodations in multiple locations.

Core Benefits and Additional Value

Individuals who place importance on transportation coverage and reliable credit functionality can appreciate how AEON Suica Credit Card aligns with those needs on a global scale. This card folds various benefits into one platform:

- Integration with Suica Transit: Combine credit payments and bus or train fares using a single card, which helps cut down the chance of forgetting separate travel passes.

- Scheduled Shopping Discounts: Take advantage of recurring discount days (often on the 20th and 30th each month) where a 5% price reduction applies at participating stores.

- Boosted Point Earning: Score double WAON Points on designated “Point Day” promotions, such as the 10th of each month, or enjoy two points per 200 yen at certain partner locations.

- No Extra Coupon Requirements: Obtain discounts automatically once card details are successfully used at checkout, which eliminates the need to remember codes.

- Travel Rebates: Get money off certain travel agency bookings and hotel reservations in Japan, contributing to lower trip expenses.

Eligibility Criteria and Documents You Need to Prepare

Potential cardholders must fulfill a few qualifications, which ensures that each application meets the general standards set by AEON.

Submitting the correct paperwork without missing any required details also minimizes processing delays. Individuals anywhere in Japan can follow these guidelines.

Primary Qualifications

- Applicants generally must be at least 18 years of age.

- A local bank account is essential because monthly billing relies on direct debit or an equivalent payment setup.

- Financial stability or steady income is taken into account. Regular salary slips, tax returns, or bank statements can serve as proof.

- A positive credit history often strengthens the likelihood of swift approval.

Essential Documents

- Identification: Passport, driver’s license, or residence card.

- Income Verification: Recent pay stubs (usually three months), tax statements, or bank records for self-employed individuals.

- Bank Account Information: Necessary for billing and automatic monthly deductions.

- Proof of Address: Utility bills or official documents displaying current residential details.

Having this documentation at hand makes it easier to complete the application form and ensures everything is accurate and verifiable.

Setting Up a Bank Account (If Needed)

Numerous applicants already have existing bank accounts, but sometimes an additional local account is required to ensure proper billing.

This step applies to residents or temporary visitors in various parts of Japan who want to link their AEON Suica Credit Card to a domestic bank.

- Visit a preferred bank branch and carry your valid identification.

- Fill out the bank’s application form thoroughly, providing accurate personal data.

- Make an initial deposit if the bank’s guidelines require it.

- Wait for confirmation regarding account opening, which usually takes a few business days.

Once a local bank account is active, linking it to your new credit card becomes straightforward, which facilitates direct monthly payments without additional manual steps.

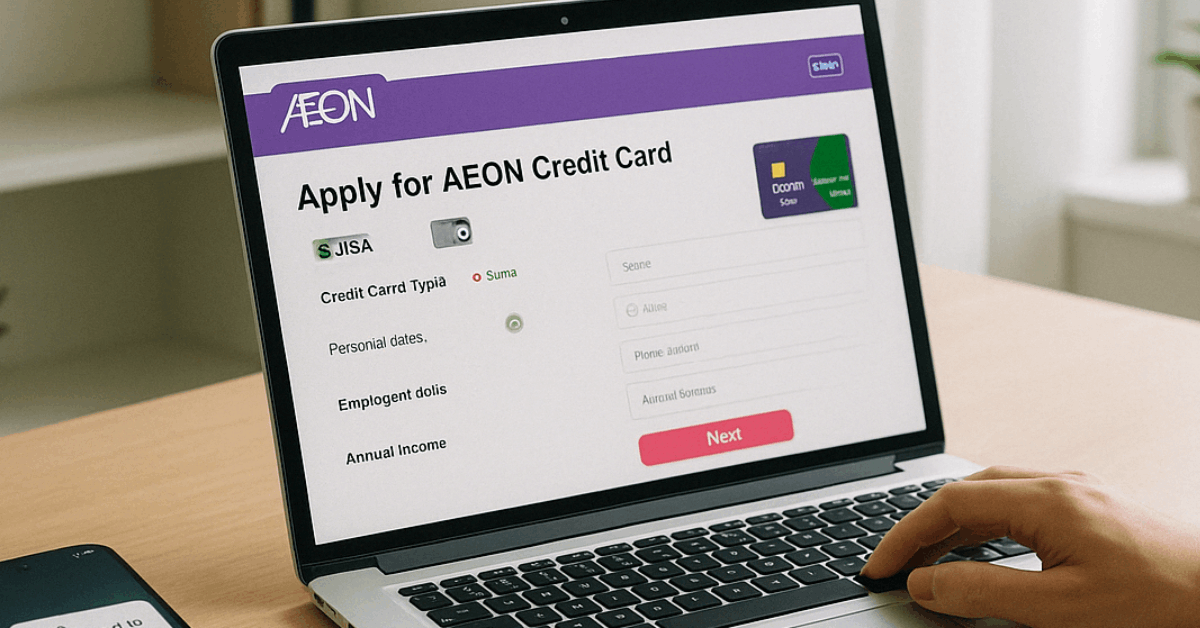

Step-By-Step Instructions to Apply for the AEON Suica Credit Card Online

An online application procedure streamlines the process, allowing you to complete everything from a computer or mobile device. Global users can follow these steps to minimize errors and potential delays.

- Access the Official AEON Website: Navigate to the correct page dedicated to AEON credit cards. Confirm that the URL has “https” for security. Look for the AEON Suica Credit Card section.

- Initiate the Application: Select the link or button that begins the online application form. An on-screen prompt will guide you through each part of the process.

- Enter Your Personal Information: Provide your full legal name, up-to-date address, active email, and phone number. Avoid abbreviations or nicknames to keep records consistent with your identification documents.

- Add Employment and Income Details: List your employer or detail self-employment income. Include your average salary or monthly revenue. Transparency here ensures a more accurate review by the issuer.

- Review and Upload Documents: Attach scans or clear photos of ID, proof of income, and other supporting records. Double-check file formats and clarity. A mismatch or unreadable document may cause delays.

- Confirm the Application: Revisit every form field to confirm the correct spelling of addresses, names, and contact details. Errors can lead to follow-up requests or rejections.

- Submit and Wait for Approval: Click the final submission button and watch for a confirmation message. Processing typically takes anywhere between 2 to 7 business days. You might get an email or phone call if additional proof is required.

- Check Your Email for Updates: Monitor your inbox regularly for notifications regarding your application status. Quick responses to any clarification requests from the issuer accelerate the timeline.

Rewards, Points, and Discount Opportunities

The AEON Suica Credit Card offers multiple chances to gain value through strategic usage. This is particularly valuable for cardholders who frequently shop at AEON-affiliated stores or use public transportation in Japan.

- WAON Points on Daily Purchases: One WAON Point per 200 yen spent (tax included). At certain partner stores, the rate doubles to two points per 200 yen.

- 5% Discount Days: The 20th and 30th of the month often trigger a 5% discount on eligible purchases, which automatically applies at checkout without requiring coupons.

- Double Points on the 10th: AEONCARD W Point Day grants double WAON Points, helping you reach higher redemption tiers faster.

- Movie Ticket Reductions: Save 300 yen on standard cinema tickets, with an additional discount to 1,100 yen on select promotional days. Guests accompanying the cardholder may receive similar benefits.

- Travel-Related Savings: Book tours through approved agencies to earn a 3,000-yen discount or get as much as an 8% deduction when arranging hotel stays in Japan through particular booking platforms.

Harnessing these promotions consistently helps boost overall savings. Cardholders who commit to thorough planning can notice a noticeable decrease in monthly expenses once they align their spending with the discount calendar.

Interest Rates and Associated Fees

Every credit card involves costs that affect the total price of using credit for everyday transactions. AEON Suica Credit Card includes an Annual Percentage Rate (APR) that ranges based on creditworthiness.

Interest Rate Structure

- Standard APR: Generally 7.8% to 18.0%, depending on your financial credentials.

- Penalty APR: Increases up to 20.0% if payments lag behind schedule. Maintaining timely payments helps avoid these higher charges.

Fee Highlights

- Annual Fee: May vary, so it is wise to consult the most current information from AEON’s official resources. Some AEON card types waive this completely.

- Foreign Transaction Fees: If you make purchases in foreign currencies, expect an extra charge that raises the total cost of those transactions.

- Late Payment Penalties: Whenever a monthly due is missed, extra fees or higher interest rates may apply. Prompt payments maintain a lower cost.

Preparing for these fees and charges creates a more accurate budget. This awareness also encourages the practice of balancing monthly payments on time to sidestep costly penalties.

Effective Methods to Manage Your AEON Suica Credit Card

Staying in control of balances, due dates, and potential discounts maximizes the benefits of this card while reducing the risk of accumulated debt or overlooked rewards.

- Activate Online Account Management: Register for AEON’s website portal to view statements, monitor recent expenses, and confirm that all transactions look correct.

- Check Balances Frequently: Log in regularly or use the official AEON Suica app to ensure that your available credit and transit balance remain within comfortable limits.

- Enable Spending Alerts: Switch on notifications for each card transaction. Early detection of unusual charges can prompt you to contact support immediately.

- Set Up Automatic Payment: Scheduling automatic bank deductions reduces the likelihood of missed bills. This tool keeps your credit record in good shape.

- Track and Redeem Points: Convert your accumulated points into coupons, Suica top-ups, or credit on your statement. Keeping track of your points helps ensure you never miss redemption opportunities.

Customer Support and Contact Information

AEON provides various global support channels to handle concerns about your AEON Suica Credit Card, including questions on billing or clarifications on promotions.

- Phone Assistance: Dial 0570-071-090 for straightforward responses to urgent questions or problems.

- Mail Support: Address inquiries or documentation to 1-5-1 Nakase, Mihama-ku, Chiba-shi, Chiba 261-8515.

- Online Help: Log in to your online account to submit queries or requests through official contact forms.

Providing the support team with relevant information, such as your card number or recent transaction details, helps speed up the resolution.

Conclusion

The AEON Suica Credit Card combines everyday spending and transit payments into one convenient tool. With a simple online application and the right documents, approval is straightforward for those with steady income and good credit.

Understanding interest rates, fees, and rewards helps you manage finances while enjoying discounts, points, and travel perks across Japan. It’s ideal for anyone seeking a lighter wallet and seamless payments.

Disclaimer

Rates, fees, and terms may change. Always check AEON’s official website or contact support for the latest details. Use the card responsibly and track expenses using the provided online tools.